Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

As the summer produce season hits its stride, the agricultural industry finds itself caught in a storm of compounding pressures.

Labor enforcement crackdowns, extreme weather events, and tightening supplies are factors not only challenging growers across the country but also testing the resilience of regional markets and summer supply chains.

ProduceIQ Index: $1.25/pound, +3.31 percent over prior week

Week #25, ending June 20th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ICE raids continue to target agriculture businesses employing undocumented workers. As a result, the industry is left wondering how long it will have to endure the adverse effects before those in power act. Many fear these enforcement efforts will ultimately damage domestic produce production in the United States.

Meanwhile, a dangerous and rare June heat wave is sweeping across the Midwest and Northeast. This weather event aligns with forecasters’ earlier predictions of a warmer-than-average June for growers in those regions. Although regional production will be adversely affected due to the inclement conditions, overall produce prices are projected to remain stable.

In Mexico, Hurricane Erik made landfall near the coastal city of Puerto Escondido, just south of Acapulco, last week. While early forecasts suggested minimal impact to fresh produce, the storm brought strong winds and much-needed rainfall to the Southwest. Unfortunately, grape growers were not spared, with some experiencing significant crop damage.

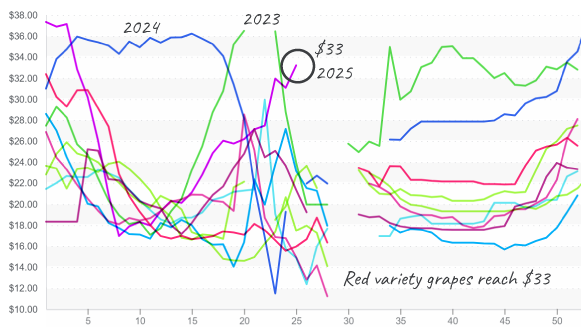

As a result, grape prices have rose 5 percent over the past week and are expected to rise further. With Mexico’s red and green grape production heavily affected and California’s peak season still weeks away, prices are now sitting at a notable high.

Red Grape prices keep rising during a time that they typically fall

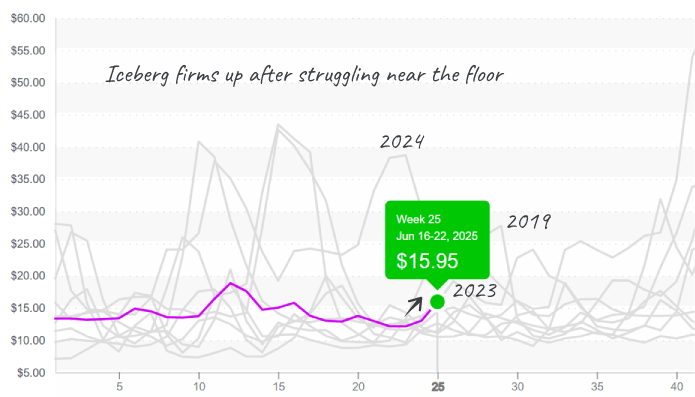

Summer—also known in the industry as salad season—has arrived with strong demand from both retail and foodservice sectors. Average romaine prices have climbed 12 percent, while iceberg lettuce is up a striking 26 percent compared to last week’s low levels. Weather-related quality issues, including heat and rain, are squeezing supply and contributing to this notable price increase, which is expected to continue in the weeks ahead.

Iceberg firms up after a time of cheap markets

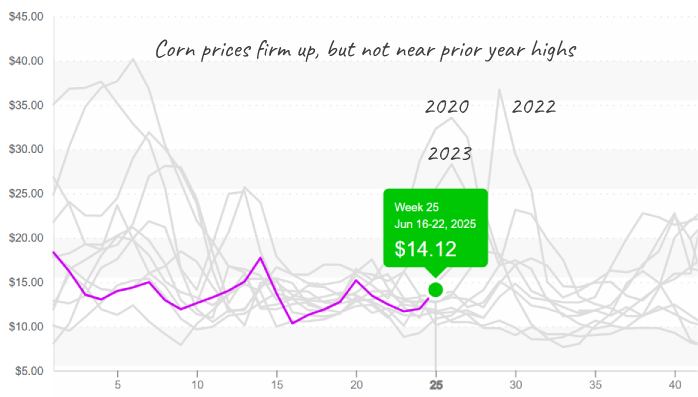

Sweet corn is also feeling the heat. Prices have jumped 17 percent week-over-week due to limited Western supply. Production in Mexico is exceptionally light for Week #25, and California won’t be ready to fill the gap for at least another two weeks. In contrast, Eastern markets are more stable, thanks to diversified production across the Southeast. Still, Western prices are projected to climb as buyers increasingly rely on regional growers to meet demand.

Sweet corn prices begin to rise, though nothing near prior years

ProduceIQ saves you time and provides valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.