Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

As summer approaches rapidly, produce markets across North America are undergoing a transition.

Shifting weather patterns, seasonal crop changes, and market pressures are all playing a role in shaping supply and pricing across the board. From early tropical threats to stone fruit optimism and market corrections in key commodities, here’s a look at the latest developments in the produce world.

Tropical activity could disrupt coastal crops. Hurricane season has officially begun in the Eastern Pacific, and early indications suggest potential activity.

A developing system is expected to become more organized in the coming days. If it strengthens into a tropical depression or storm, it could bring rain and wind to growing regions along Mexico’s Pacific Coast, potentially impacting harvests and supply chains in the area.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.55/pound, -0.6 percent over prior week

Week #21, ending May 23rd

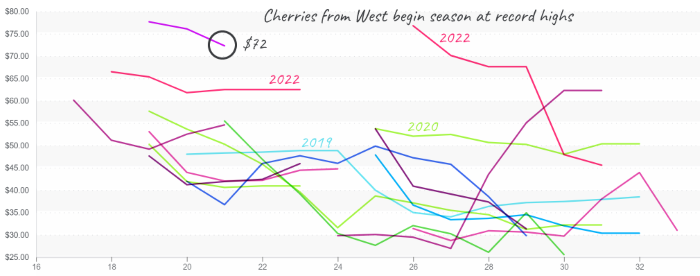

Cherries: California Shortfall, Washington Steps In

California’s cherry season fell short of expectations after rain during bloom reduced the crop to approximately 4.6 million cartons, well below the initial projection of 7 to 8 million. The lighter volume has kept prices elevated and availability tight as the state’s season winds down.

Looking ahead, Washington’s cherry season is shaping up to be strong. Growers report ideal weather and a healthy, even bloom, setting the stage for a steady harvest. Volume is expected to build starting mid-June and continue through early August, with minimal overlap from California. This transition should help stabilize the market with improved supply and quality.

Cherry prices, $72, begin the season at record levels.

Peach Season Gains Momentum

Another stone fruit, peaches, is coming on strong. Growers in California, Georgia, and South Carolina are ramping up shipments as the season moves forward. In the Southeast, growers are cautiously optimistic, thanks to ample winter chill hours and favorable spring conditions, factors that could make this one of the region’s best seasons in years.

Cucumber Market Navigates Salmonella Concerns

The CDC is investigating a Salmonella outbreak linked to whole cucumbers from the Southeast. While food safety remains a top priority, the impact on pricing and availability has been limited. Increased supply from Baja California, Mexico, and Georgia is helping to balance the market. Prices remain on the higher end of the historical range due to previously low volume but are expected to moderate as availability improves in the coming weeks.

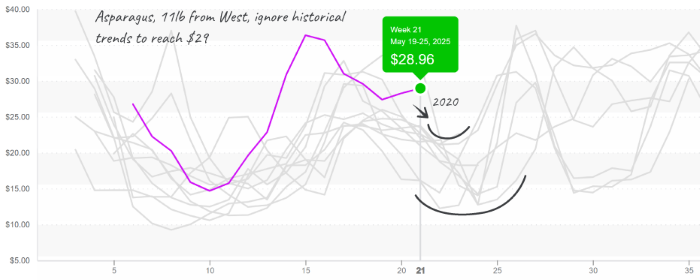

Asparagus Prices Stay High Despite Dip

Asparagus markets have eased slightly but remain close to a ten-year high. With domestic production increasing, particularly in Michigan and Washington, the market may be poised for a notable correction. Buyers should watch for shifting supply dynamics in the coming weeks as more domestic product enters the pipeline.

Asparagus markets, $29, are holding strong during a time that typically has falling prices.

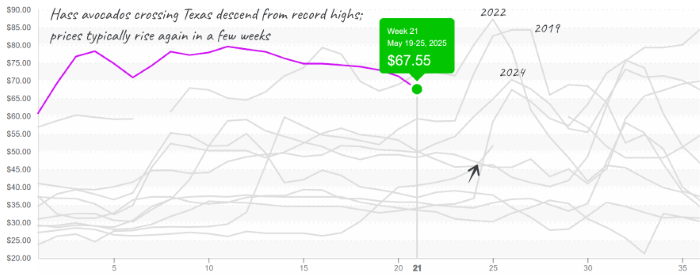

Avocado Prices May Begin to Soften

Like asparagus, the Hass avocado market appears ready for a possible decline. Increased volumes from Peru and California, paired with softening demand, are creating downward pressure. Current average prices for a 48ct through Texas are hovering around $67, well above average for week 21 and similar to the extreme price level of 2022. Meanwhile, Mexican supply will fluctuate slightly over the next month as growers transition to the Flora Loca crop.

Hass Avocado prices begin to show weakness from historic highs; prices typically rise again by week 23.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.