Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

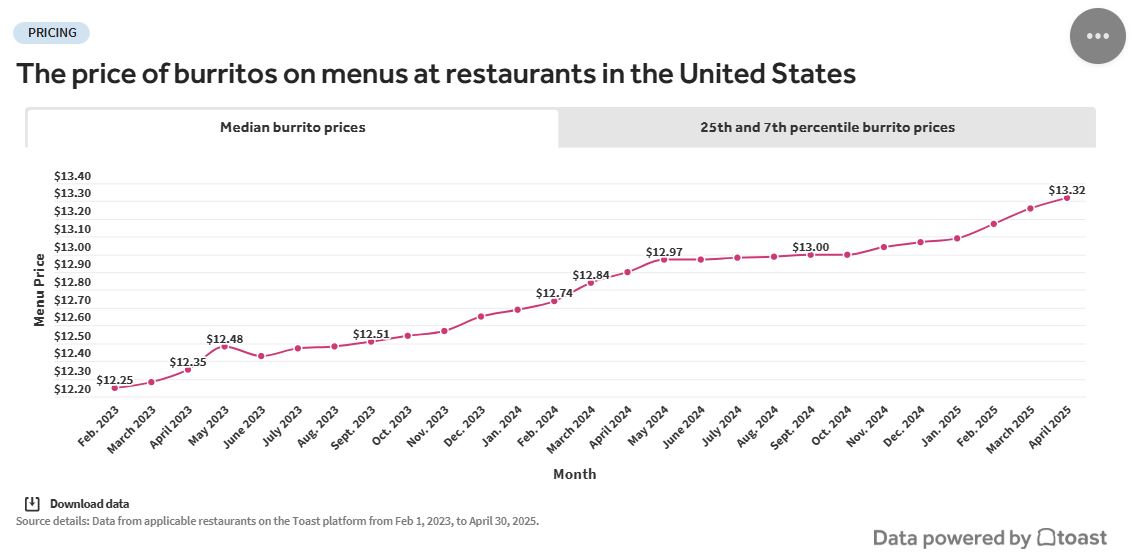

Two years ago, as inflation was slowing, government experts and pundits told consumers inflation wasn’t so bad.

Yet, consumers said it was, as one survey found consumers perceived that food inflation was over 20 percent. How to address the pain of food inflation – Blue Book

In a way, they were right. They were thinking of prices prepandemic, and to them, four years of 4, 6, 10, and 5 percent added up to prices that were up 25 percent.

Two years later, April inflation posted a year-over-year increase that was the lowest since February 2021, and fresh produce posted 0.7 percent deflation. Annual inflation cools in April to 2.3%, lowest since February 2021 – Blue Book

Nonetheless, consumers remain angry about food inflation and expect it to be much worse than it is.

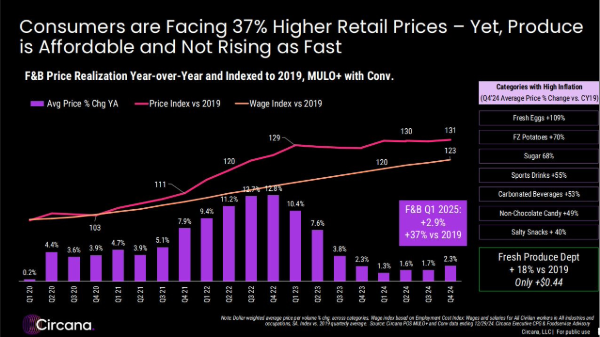

In a presentation at IFPA’s Retail Conference, Jonna Parker of Circana presented a series of consumer trends, such as that consumer confidence is quite low, and consumers expect food inflation to rise 6.7 percent over the next year. Consumer behavior shows lingering pain from inflation – Blue Book

Tariffs have them spooked, as shoppers say fresh produce is the No.1 category of consumer goods that they expect to see the impact of tariffs.

So far, as inflation figures show, that hasn’t been the case.

It may be starting though, as Walmart said this week it plans to begin raising prices because of tariffs. Many of them will be on products from China, which has had tariffs as high as 145 percent but are now at 30 percent after a temporary reduction. Walmart to start raising prices due to tariffs – Blue Book

Walmart said it plans to raise banana prices, which are subject to 10-percent tariffs, from 50 cents per pound to 54 cents per pound.

But think about that. A consumer who buys a large hand at 2.5 pounds will see a price increase of 10 cents total. For most, that will hardly be noticeable.

Parker said Circana considers fresh produce moderately price sensitive, and commodities generally fit into high, moderate, and low sensitivity, in thirds.

Bananas are joined by apples, tomatoes, and onions in the low sensitivity group, so tariff or inflation increases on those will not produce much difference in demand.

In the high category are items such as peaches, mandarins, grapes, and mushrooms.

Retailers who raise prices on these items are more likely to turn consumers away from those or even those whole categories.

Walmart isn’t the largest retailer in the world by accident. It’s possible it knows what it’s doing by publicly using bananas as a tariff example, knowing it’s a low price-sensitive item.

It will be fascinating to watch how other retailers handle consumer communications with tariff price increases.

Consumers are pessimistic and still angry about food inflation, but on some items, probably less so.