Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

Images courtesy ProduceIQ

As a heat dome settles over the southern U.S. and tropical activity intensifies in both the Atlantic and Pacific, growers are closely monitoring the skies while markets respond to shifting supply.

Triple-digit temperatures are expected this week from Kentucky to Florida, adding stress to fields already in transition.

Meanwhile, two tropical disturbances—still over a week out—are developing on both coasts, serving as early reminders that peak hurricane season is just around the corner. Against this backdrop, produce prices are on the move, with sweet corn surging, avocado prices softening, and cherries plunging to record lows.

ProduceIQ Index: $1.02/pound, -4.7 percent over prior week

Week #29, ending Jul 18

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Sweet corn is difficult to find, and prices continue to climb in the face of short supply. Eastern supply is in transition. Growers in Georgia are done or winding down, while those in Tennessee and Virginia have yet to begin, and demand remains strong. Eastern supply is expected to pick up again in the next two weeks.

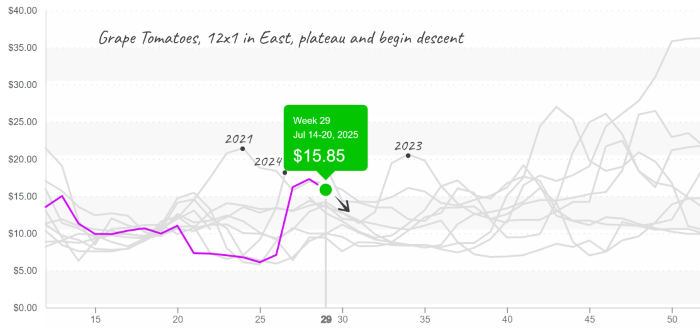

After three weeks of escalating prices, grape tomato prices are finally showing relief for buyers. Growers in Tennessee have started slowly, and growers in Virginia are expected to come online next week. At $16, average prices are above the historical average for week #29 but follow the general trajectory of prices for this time of year.

Grape tomato prices begin to decline after a steep 4-week climb.

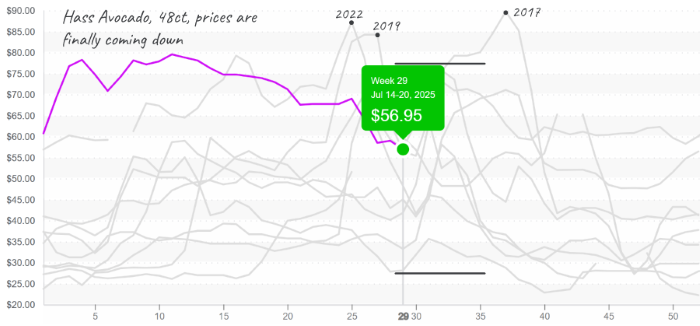

Average Hass avocado prices are finally declining due to an increase in volume as suppliers transition to the Loca variety. Prices are down -4 percent over the previous week but are still well above average for week #29. Production in California is cooling off, but increasing supply from offshore growers is slowly swinging the price pendulum away from demand and towards supply. As supply from Mexico increases over the next few weeks, prices will likely continue their steady decline.

Hass Avocados, 48ct, are being shipped through Texas, and prices are declining during an otherwise expensive year.

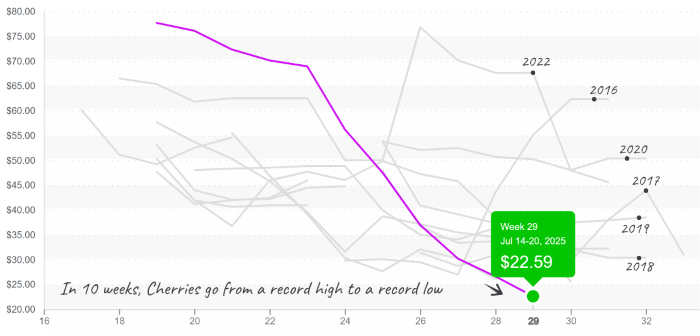

Cherry prices are at record lows. Down another -15 percent over the previous week, average cherry prices descend to new lows as the domestic cherry season nears its peak. California’s production season is over, and volume from Washington is in full force. And, don’t forget the tasty cherries being harvested in northern Michigan.

Cherry prices fall steadily from $77 to $22 over a period of 10 weeks.

ProduceIQ saves you time and provides valuable information to increase your profits.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.