Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

President Trump hinted that he’s listening. Shortly after riots erupted over immigration raids in Los Angeles’s garment district, Trump tweeted “Our great Farmers and people in the Hotel and Leisure business have been stating that our very aggressive policy on immigration is taking very good, longtime workers away from them, with those jobs being almost impossible to replace.”

We assume that our lobbyists are scrambling now to achieve an executive order to help address these issues.

Though the levels have declined over the past 20 years as H-2A participation has increased, it’s fair to say that approximately one half of all farm labor is not in the U.S. legally. The USDA, itself, estimates that 40 to 55 percent of the crop agriculture workforce is “undocumented.”

The ideologically easy position to deport anyone from the U.S. that is not here legally is becoming more common in the mainstream right. In response to the recent influx of illegal crossings under Democratic leadership, many conservatives have shifted towards seeking mass deportation, no longer differentiating between those with a criminal record by arguing that being undocumented, itself, is a crime.

The pendulum often swings too far. With over 13 million undocumented immigrants, the costs of arresting, detaining, legal processing and removal are in the hundreds of billions. Further, this ignores the negative impacts to the overall economy that will struggle without sufficient labor and to the morale of our communities, particularly in California, Florida, and Texas.

If America really wants food grown domestically, it should stop making it so difficult to grow food domestically! Seems obvious. We need an improved guest-worker program. And, practically, we need some pathway (yes, a compromise) for workers to gain legal status here without first being deported. Though controversial, in my worldview, we should even provide a process for those that have been here, growing our food for many years, to obtain citizenship.

The inflationary costs of land, energy, food safety, and labor are making it inevitable for our food production to relocate to lower-cost countries. The trend of “offshoring” hasn’t slowed down over the past 30 years, and the root causes of this problem are still not being addressed.

ProduceIQ Index: $1.21/pound, -6.9 percent over prior week

Week #24, ending Jun 14th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

The Dry Vegetable category began the summer in the doldrums. The typical seasonal pattern is for prices to rise as Georgia production winds down as production gaps and becomes scattered. Perhaps the economy is underwhelming from news-driven fears of tariffs and wars. Either way, demand is off from last year.

ProduceIQ’s Dry Veg Index remains -2% during the time of season that usually spikes

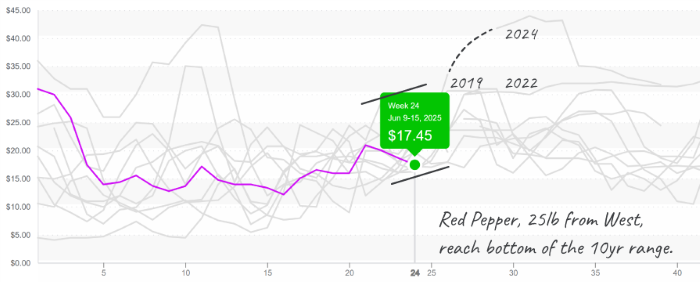

The pepper market is flat. Not much production north of Georgia yet. Red Bell Peppers are still in Mexico and remain scattered in other regions, starting California and Georgia. Canadian are offering some cheap deals.

Red Bell Pepper prices, $17 for a bushel 1/9, are showing major weakness

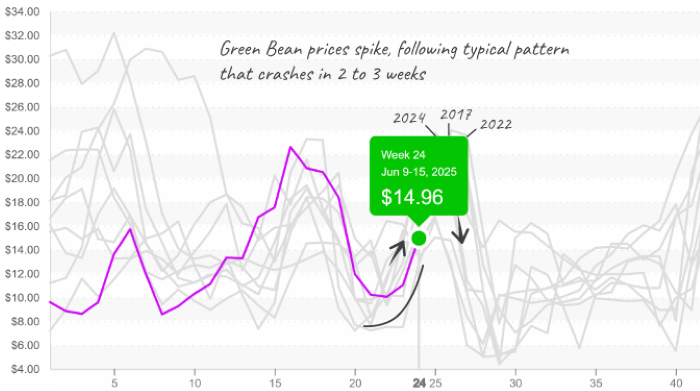

Green Beans are accelerating in their normal pattern. Bean supply remains in good quality and could use additional promotion.

Green Bean prices jump to $15 within a normal pattern that exceeds $20 in two weeks

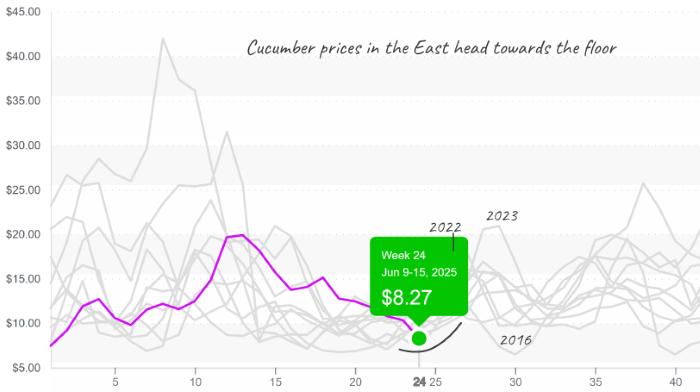

Most Cucumbers are down, reaching $8, but Super Selects, at $14-8, are a rare bright spot. Demand may remain down due to the most recent food safety recall in South Florida. Georgia is feeling the pinch of trucks because more “local” deals are beginning to open. New Jersey has Squash now and will start cukes soon. Major eastern markets will try to move to the closer, new crop.

Cucumber prices continue the 10-week downward trend towards the floor

ProduceIQ saves you time and provides valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.