Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

Courtesy ProduceIQ

As Memorial Day approaches, fresh produce demand is heating up, despite some simmering concerns over tariffs and shifting weather patterns.

According to Walmart CFO John David Rainey, tariffs are pushing up the price of bananas and other imported fruits. While these increases may not impact short-term demand, the long-term effects on consumer habits remain uncertain.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.56/pound, -3.1 percent over prior week

Week #20, ending May 16th

Weather will also play a pivotal role in shaping this season’s produce landscape. A warmer-than-average summer is expected across most of the United States; conditions are currently ENSO-neutral, neither particularly El Niño nor La Niña.

Retailers are already seeing a surge in demand for cookout-ready favorites like watermelon, strawberries, and barbeque-friendly vegetables such as peppers and potatoes.

Meanwhile, the domestic stone fruit season is just beginning. Supplies of peaches, cherries, plums, and apricots are expected to rise gradually through May, with promising forecasts for this year’s cherry crop in terms of both yield and quality.

Berry Prices Cool Just in Time for the Holiday

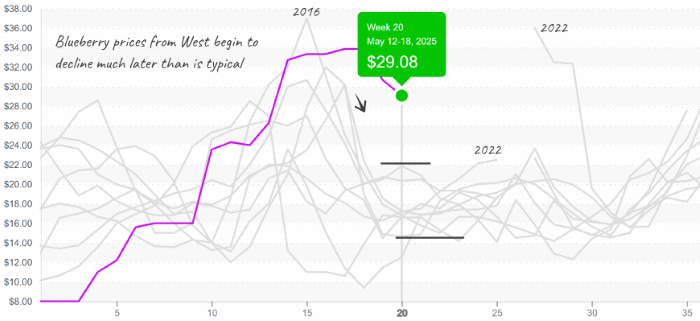

Strawberry, raspberry, blackberry, and blueberry prices are beginning to soften—perfectly timed for Memorial Day festivities. Blueberries and strawberries are seeing the steepest week-over-week declines, with average prices down -16 percent and -15 percent, respectively. Rising production in California is providing much-needed relief for price-weary berry buyers preparing for picnics and backyard gatherings.

Blueberry prices remain at all-time highs because they haven’t fallen as fast as in prior years.

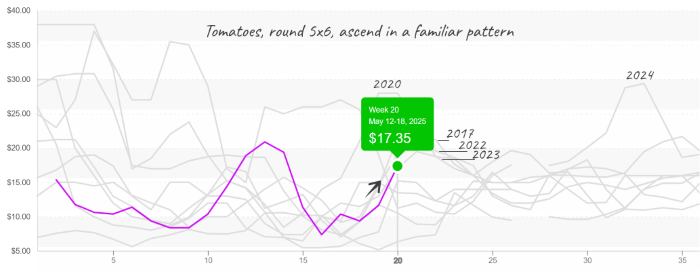

Tomato Prices Heat Up

Round tomato prices, however, are heading in the opposite direction. Last week’s rain delays in Florida and Georgia have revealed a notable supply gap, pushing average round prices up by +43 percent over the previous week. Prices may climb further as growers in Mexico work to fill the void, while Florida’s production begins its seasonal shift northward. For holiday shoppers, this means pricier tomatoes at the store, just as salsa and sandwich season kicks off.

Tomatoes, 5×6, prices rise, reaching $17, and typically rise for another week.

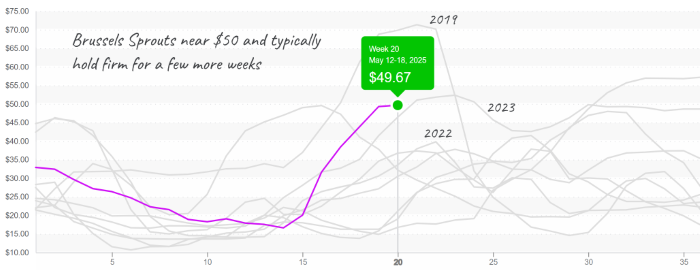

Brussels Sprouts Remain Hot, In Price

Holding strong at an average of $50, Brussels sprouts continue their record-breaking streak. Pest pressure and low yields are tightening supply, inflaming markets, and pushing prices upward. Some relief is expected over the next three weeks as growers in California’s Salinas and Watsonville regions ramp up production, though likely not in time for Memorial Day spreads.

Brussels sprouts prices reach their 2nd-highest prices, only behind 2019.

Beans Crash—In a Good Way

Bean lovers will have something to celebrate. As is typical for this time of season, prices have taken a dramatic dive, down -47 percent compared to the previous week. Expanding supply from Georgia and Florida is putting strong downward pressure on the market. With additional domestic growing regions set to come online in June, prices are expected to remain low, a welcome break for consumers stocking up on side dish staples for holiday meals.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.