Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

The Southeast is in for another stretch of warm, dry conditions as an Omega block weather pattern settles over North America.

However, you wouldn’t have known it from the rain-soaked opening lap of the Formula 1 Grand Prix in Miami on Saturday. While drivers fought for grip on the wet track, produce markets across the continent are navigating their own high-speed turns, weather obstacles, and pricing shifts.

From tightening grape supplies to a sharp drop in blueberry prices, growers are handling a tricky blend of seasonal transitions and climate challenges.

Onion prices are accelerating as new regions come online, and limes are holding firm in the fast lane thanks to Cinco de Mayo demand. All eyes may have been on Miami for the F1 spectacle, but there’s plenty of action unfolding in the fields, coolers, and supply chains of North America.

ProduceIQ Index: $1.29/pound, -2.3 percent over prior week

Week #18, ending May 2nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

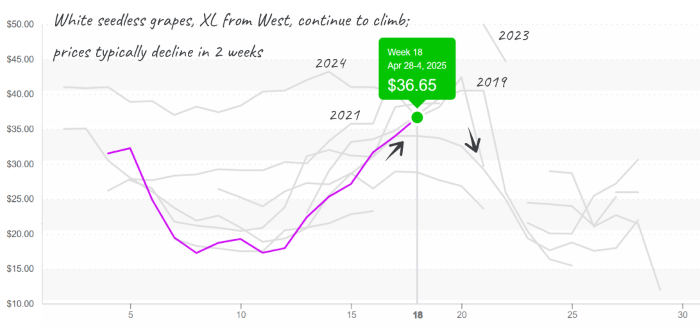

Grapes: Leading the pack

Grape prices have jumped by +6 percent over the past week, moving into podium territory with the third-highest levels seen in the last decade. Offshore production is slowing down, while Mexico is just getting off the starting grid — but it’ll take another 2–3 weeks before volumes are high enough to fill the gap. Green grapes are pulling ahead of red in terms of price increases, though both are showing mixed quality as they race through the supply chain.

Table Grapes, white seedless XL, climb past $36

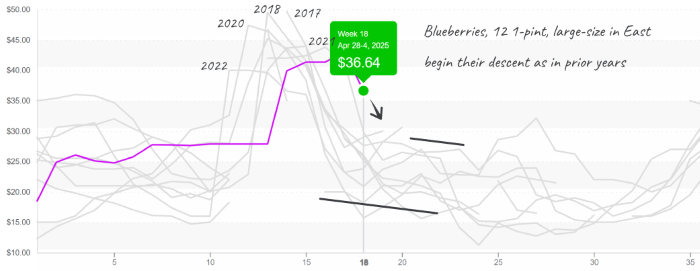

Blueberries: A dramatic pit stop

Blueberry prices took a sharp -26 percent dive this week — a move that might look like a spinout on the charts — but they’re still holding at a ten-year high. Production in Florida and Mexico remains light, but Georgia growers are eyeing better conditions and hoping for a volume boost soon. With luck, Southeast blueberry growers may be back in the race in no time.

Blueberry prices begin their seasonal descent as Georgia improves supply.

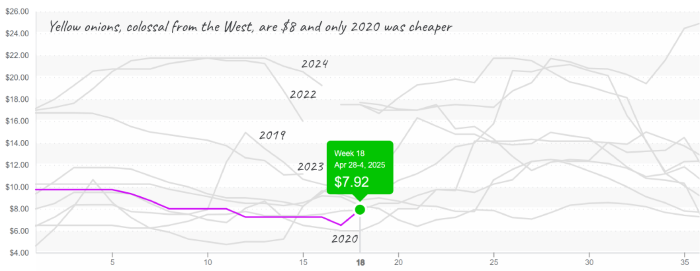

Onions: Gaining speed

The onion market is shifting gears. As Northwest production winds down, growers in the Southwest are ramping up. Prices for dry onions are up an average of +7 percent — a welcome relief since current pricing is well below average. Expect a gradual climb over the next 3 to 6 weeks as the market adjusts to the shorter shelf life of the new crop.

Yellow Onion prices are $8, which is a bargain compared to most recent years.

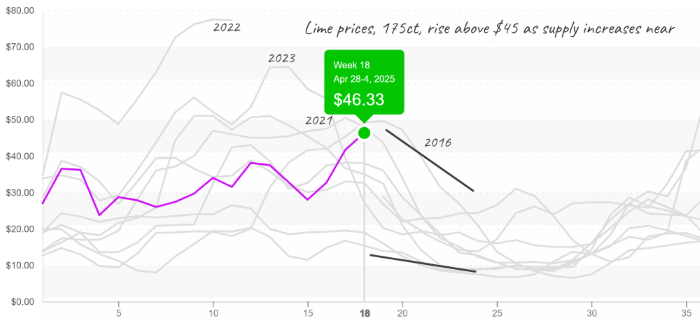

Limes: Holding the racing line

Lime prices are defying typical week #18 trends, thanks to lighter border crossings and the turbo boost from Cinco de Mayo demand. Most of the fruit is peaking at size 200 and smaller. While things are hot now, the pace is expected to ease after the holiday as more Mexican supply enters the market.

Lime prices, 175ct through Texas, are climbing when most years, prices were already in decline.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.