Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

Images courtesy ProduceIQ

Heavy rains and flooding in key U.S. growing areas are changing produce markets as August approaches. From Mexico to the Carolinas, severe weather is interrupting harvests and pushing prices up for summer favorites like sweet corn, bell peppers, squash, and tomatoes.

ProduceIQ Index: $1.07/pound, -5.3 percent over prior week

Week #28, ending July 11th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Texas is facing the aftermath of the deadliest rain-driven flash floods in the U.S. since 1976. Just nine days after the devastating floods that killed 129 people in Kerr County, more floods are affecting central Texas. In only 45 minutes, river levels surged an incredible 26 feet, sweeping through rural communities and farmland. Additional rain and possible flooding continue to threaten the forecast for Texans this week.

Tropical Storm Chantal made landfall in South Carolina on July 7, bringing heavy rains and flooding localized across the Carolinas and nearby parts of the Southeast. Although it was downgraded to a tropical depression shortly after landfall, the system still caused intense rainfall, with totals of 4 to 6 inches in some areas and isolated totals reaching up to 12 inches.

The storm’s timing wasn’t ideal for regional farmers. Flooding in North and South Carolina has delayed summer harvests of corn, tomatoes, squash, and melons. Growers say the storm may also affect planting schedules for late-summer vegetables. Some operations have temporarily halted picking crews, and supply chain disruptions are expected in local and regional produce markets through mid-July.

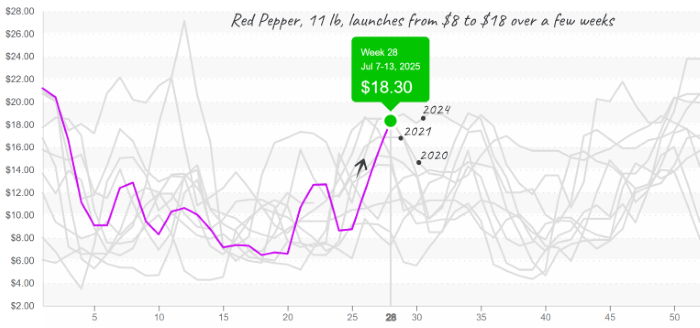

Bell pepper supply remains low due to transitions from growing regions in Southern Georgia and Coachella, while Mexican supply is very limited because of heavy rain. Additionally, last week’s rain in the Southeast has delayed the start of new growing areas by 7-10 days.

Red Pepper, large to Jumbo, 11 lb., prices are spiking

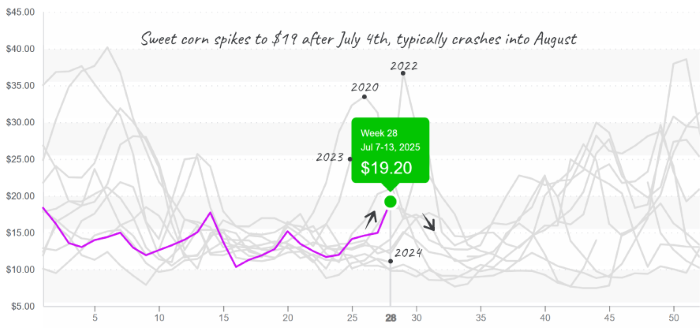

Eastern supply of sweet corn flounders as production shifts northward. Average sweet corn prices have increased by 35 percent over the previous week and are currently at $19, which is well above the average for week #28, though not in unprecedented territory historically. Prices are likely to reach their summer peak within the next two weeks as production in the east and west moves north.

Corn prices rise after Independence Day

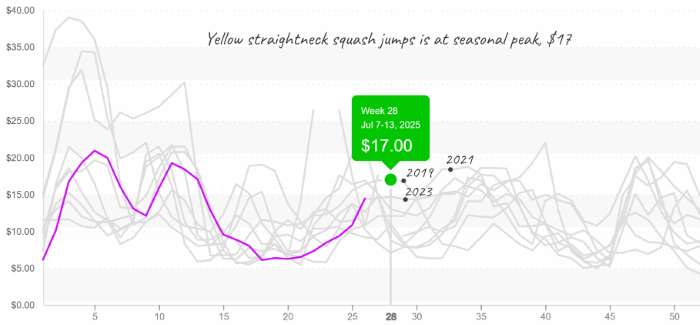

Summer plans squashed as average squash prices hit a ten-year high. Similar to the story behind bell peppers and sweet corn, reduced squash production in the Southeast, combined with bad weather, is driving squash prices far above normal in week #28.

Yellow straightneck squash prices reach seasonal high of $17

While all the ProduceIQ index’s tomato categories are increasing, average grape tomato prices are notably higher than the historical norm for week #28. Rain and low supply are disrupting markets and driving prices up. Production in Tennessee and Virginia should increase in the next few weeks, offering some relief to the stretched supply.

ProduceIQ saves you time and provides valuable information to increase your profits.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.