Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

A wet Mother’s Day weekend is bringing much-needed rain to the Southeast. While this rainfall coincides with the start of vegetable harvesting in Georgia and the Carolinas, growers in parched South Florida will remain comparatively dry as their spring season comes to a close.

On the global stage, a labor strike in Panama has raised concerns about potential disruptions to imports of tropical fruits such as bananas and mangos. For now, the strike is having minimal impact on U.S. produce prices, as long as shipping through the Panama Canal remains unaffected.

ProduceIQ Index: $1.61/pound, +24.9 percent over prior week

Week #19, ending May 9th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

The ProduceIQ Index was catapulted by the start of cherry season, which began at record-high prices. We have not seen a 25 percent increase in the Index, except on extremely rare occasions. At $1.61, the Index is quickly approaching its all-time high of $1.64.

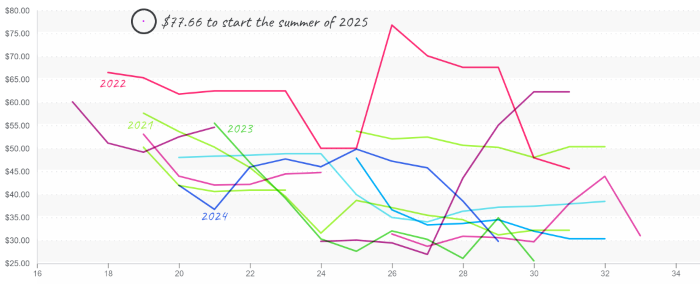

The domestic cherry season is kicking off at $78, a steep start to the summer. A cooler-than-usual spring has delayed harvest by about a week. While fruit quality is reportedly strong, yields remain on the lower end of historical averages. California growers have begun harvesting lightly, and production will gradually expand into the Pacific Northwest as summer approaches.

Cherry prices open the season at all-time highs.

U.S. produce markets are entering a period of rapid transition. With spring production winding down, price volatility is emerging across several key categories. Other than cherries, tomatoes are climbing sharply, bean supply is improving, and lime prices remain stubbornly high. Below is a breakdown of this week’s notable market movements:

Tomato prices are rising quickly as spring production declines. Average round tomato prices are up +43 percent over the previous week due to falling supply in both the East and West. Supply is expected to fluctuate heavily over the next few weeks as markets shift toward summer growing regions.

Tomatoes, vine-ripened, 4×5 in the East, prices spike from imported floor levels.

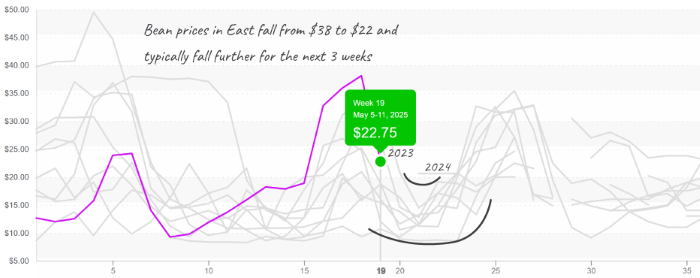

Bean supply is increasing, and prices are easing as growers in Southern Georgia and Northern Florida ramp up production. Despite declining output from Mexico, average prices have fallen by -40 percent week-over-week. This downward trend is likely to continue as more growers in the Southeast and Mexico come online in the coming weeks.

Bean prices in the East free fall from a record high.

Lime prices continue to defy seasonal expectations. Despite entering a period when prices typically decline, low volumes from Mexico and strong demand are keeping prices elevated. Week #19 volume is on the lower end of the historical range, though not unprecedented. Large-sized fruit is particularly scarce, while smaller sizes are more readily available.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.