Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

Images courtesy ProduceIQ

While you were grilling burgers and celebrating Independence Day, extreme weather was hard at work disrupting produce markets across the country.

In California, the Madre Fire isn’t directly hitting farmland near Bakersfield, but smoke has the potential to slow down harvest crews by affecting air quality. The wildfire is the largest in California this year. Down in Texas, historic flooding has left over 80 dead and local farms and infrastructure destroyed.

And in the Southeast, Tropical Storm Chantal is dumping heavy rain that’s delaying harvests and raising the risk of crop damage. However, losses from all three inclement weather events will likely remain localized and affect production only at the regional level.

ProduceIQ Index: $1.13/pound, -11 percent over prior week

Week #27, ending July 4th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Despite the volatile and tragic weather events, the ProduceIQ index is well below average for week #27 due to the historically low prices of heavily weighted commodities such as cherries and raspberries.

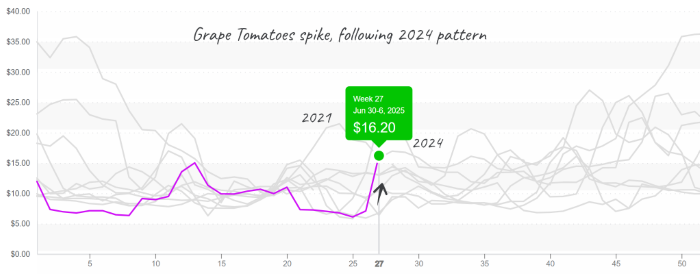

Grape tomato prices are up by +86 percent over the previous week due to low supply in the East and West. Growers in Tennessee are expected to ramp up production this week, which should provide some much-needed relief to strained supply lines.

Grape tomato prices double to $16

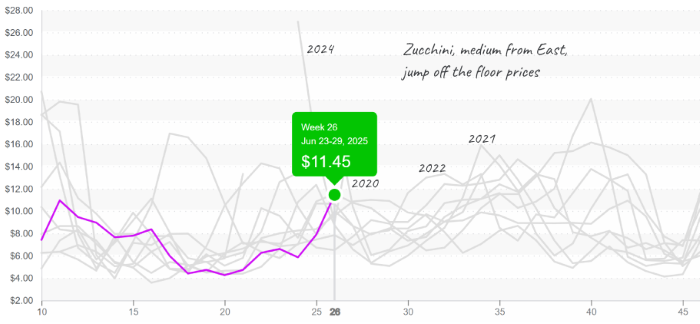

Squash prices have risen by +33 percent over the previous week, climbing above average for week #27. In the East, yellow squash production is winding down in South Georgia and has yet to pick up in newer growing areas. Out West, zucchini output remains below normal, further pushing prices upward. Average prices are expected to stabilize in the coming weeks as additional growers come online and help rebalance supply.

Zucchini reaches $11, finally leaving the floor prices

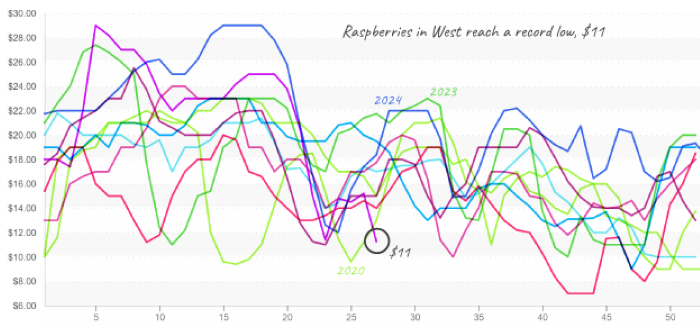

As raspberries reach peak production, average prices reach a 10-year low. Prices are down -26 percent over the previous week. And at $11, raspberry prices are indisputably cheap. If raspberry markets follow historical trends, prices are likely to stabilize or rise slightly throughout the remainder of the summer season.

Raspberry prices reach a new low and are ready for heavy promotions

ProduceIQ saves you time and provides valuable information to increase your profits.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.