Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

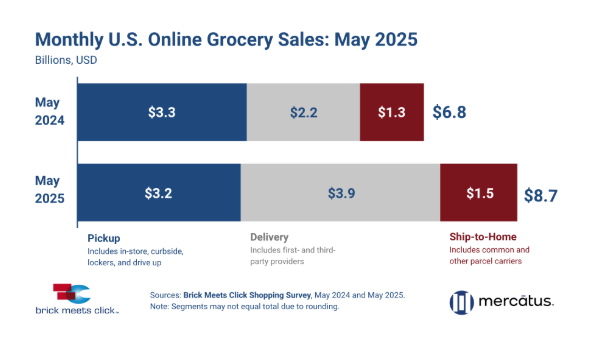

Barrington, Ill. – June 10, 2025 – U.S. online grocery sales in May 2025 finished at $8.7 billion, a 27.0% increase compared to last year with Delivery driving nearly all the gains, according to the Brick Meets Click Grocery Shopper Survey fielded May 30-31, 2025, and sponsored by Mercatus.

While this marks the first month since August 2024 when total monthly sales have fallen below $9.5 billion, a larger month-over-month decline had been expected based on seasonal patterns seen across eGrocery.

Total eGrocery sales for May 2025 fell 12% from April 2025, compared to 16% and 20% for the same months in 2023 and 2024, respectively, due to Delivery’s strong results this year.

Delivery registered a massive sales lift in May 2025, greater than 70% compared to last year, as monthly sales climbed to $3.9 billion. This sales jump was driven by sizable gains in the monthly active user (MAU) base combined with a double-digit jump in order frequency and higher average order values (AOV) compared to last year. Consequently, Delivery’s share of eGrocery sales jumped nearly 13 points YOY to 45.4% in May 2025.

“Delivery’s high growth rate for May is an outlier and reflects the cumulative impact of wave after wave of promotional activity that began fueling stronger sales for the service method in June 2024,” said David Bishop, Partner, Brick Meets Click. “While these promotions generally appeal to existing customers, Walmart’s effort is also helping the retailer to attract new customers. But, either way, it’s helping to grow Delivery’s user base, order frequency, and AOV.”

Pickup sales fell 3.6% year-over-year (YOY) to $3.2 billion in May 2025. The sales decline happened despite mid-single-digit growth of the method’s MAU base that could not offset a drop in order frequency and slightly lower AOV. As a result, Pickup lost over 11 points of sales share versus last year, finishing with 37.2% in May 2025.

Ship-to-Home appears to benefit indirectly from Delivery’s boom, mainly in Mass, as the method surged 20.7% YOY in May 2025 to $1.5 billion. The ability to buy products from pure-plays at prices on par with physical stores and enjoy free shipping from an expanding range of providers is likely one factor triggering higher demand. Even though the method posted gains in its MAU base coupled with lifts to order frequency and AOV, Ship-to-Home lost 90 basis points (bps) of sales share, ending the month with 17.5%.

As for customers who completed at least one eGrocery order during the month, the overall base of MAUs – which includes all receiving methods and retail formats – expanded more than 10% in May 2025 versus last year, but the expansion was not evenly distributed. Delivery’s specific MAU base grew three times that rate YOY and Walmart saw its MAU base for all three online grocery methods expand about one and one-half times faster than the overall rate.

Overall eGrocery order frequency rose over 10% YOY in May 2025, due almost entirely to increases connected with Delivery. Pickup’s rate contracted, and Ship-to-Home’s rate grew but to a smaller degree than Delivery. These results are not surprising since Delivery is the primary beneficiary of the numerous membership and subscription offers flooding the market over the last twelve months as these programs motivate increased usage.

The weighted average AOV, based on sales across all three methods, posted a small YOY gain of just under 4%. As with order frequency, Delivery reported the highest YOY increase and double the gain posted by Ship-to-Home while Pickup AOV contracted slightly.

In addition, customer satisfaction as measured by expectations for continued usage finished May on a high note compared to last year. The repeat intent rate for May 2025 increased 900 bps versus last year, ending the month at 66.8%. Repeat intent rates improved YOY across all customer types, spanning from first timers to the more engaged/frequent users. This trend was also seen across key retail formats, like Mass and Grocery (including Supermarkets and Hard Discounters), as well as Delivery and Pickup.

Ensuring customers are satisfied is essential as cross-shopping continues to climb. The rate of cross-shopping between Grocery and Mass rose more than two points this year, ending May 2025 at 33.7%. Meanwhile the comparable rate between Grocery and Walmart increased by over four points YOY. This means that one out of four households in Grocery’s MAU base also completed an online grocery order with Walmart sometime during May 2025, up from one out of five last year.

“These results show how quickly shopper demand has shifted to Delivery over the last 12 months, raising the stakes for regional grocers,” said Mark Fairhurst, Chief Growth Marketing Officer, Mercatus. “While collaborating with delivery platforms is often essential for grocers, the key is to ensure that these partnerships strengthen – not weaken – their connection with the customer. Regionals that control the digital experience, leverage Pickup’s first-party strengths, and build trust through personalized experiences will be best positioned to retain loyalty and share as the market evolves.”

For more information about subscribing to the full monthly report, visit the eGrocery Monthly Sales report page.

About this consumer research

The Brick Meets Click Grocery Shopping Survey is an ongoing independent research initiative created and conducted by the team at Brick Meets Click and sponsored by Mercatus.

Brick Meets Click conducted the most recent survey on May 30-31, 2025, with 1,488 adults, 18 years and older, who participated in the household’s grocery shopping, and a similar survey in May 2024 (n=1,724). Results are adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age and income to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau.

The three receiving methods for online grocery orders are defined as follows:

- Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus drives digital transformation for retailers through an extensive suite of connected and contextualized commerce solutions. We enhance shopper engagement, tailor experiences to individual preferences, and cultivate enduring loyalty across retail businesses of every size. Our mission is to enable retailers to captivate customers, boost sales, foster retention, and deepen loyalty in a digital world. With our cutting-edge solutions, retailers can streamline operations, enrich customer experiences, and realize substantial growth. Embark on the digital transformation journey and unleash the full potential of your retail business with Mercatus.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com