Welcome to Blue Book!

Are you ready to join the thousands of companies who rely on Blue Book to drive smarter decisions? View our plans and get started today!

Still have questions? We’d love to show you what Blue Book can do for you. Drop us a line– we’ve been waiting for you.

This is Freight Trends from DAT One and DAT iQ Spot market data for May 11-17, 2025 (Week 20):

Roadcheck effects: Load posts spiked 29% to their highest point in 2025; spot rates jumped.

The number of posted loads on DAT One jumped to 2.9 million, the highest weekly total for the year and a 28.6% increase compared to the previous week. Truck posts fell 14% to 227,772 last week, which included the annual CVSA International Roadcheck enforcement event from May 13-15. It was the lowest number of truck posts since the second week of January.

Dry Vans

▲ Van loads: 1,209,300, up 41.7% week over week

▼ Van equipment: 162,759, down 11.3%

▲ Linehaul rate: $1.70 net fuel, up 10 cents

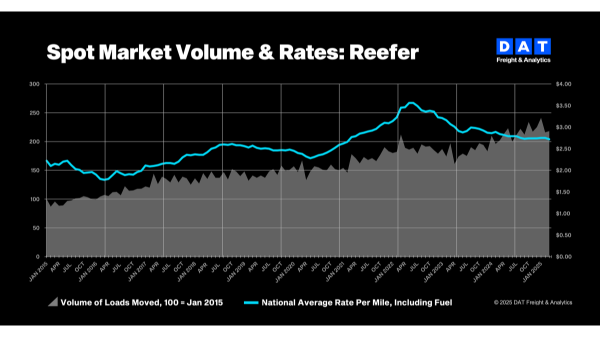

Reefers

▲ Reefer loads: 634,215, up 38.6% week over week

▼ Reefer equipment: 40,070, down 17.9%

▲ Linehaul rate: $2.05 net fuel, up 15 cents

Flatbeds

▲ Flatbed loads: 1,023,010, up 11.5% week over week

▼ Flatbed equipment: 24,943, down 20.1%

▲ Linehaul rate: $2.21 net fuel, up 6 cents

Market Notes from Dean Croke, DAT iQ industry analyst:

At $1.70 a mile, the national seven-day rolling average was 8 cents higher than last year and the highest Week-20 average in three years. On DAT’s Top 50 van lanes ranked by the volume of loads moved, carriers were paid an average of $1.96 a mile, up 7 cents week over week and 26 cents higher than the national average.

The number of dry van load posts was the highest for Week 20 in four years. Van equipment posts declined 11%; the long-term average decrease in equipment posts during Roadcheck week is 8% for dry vans. As a result, last week’s dry van load-to-truck ratio (LTR) was up 60% to 7.4, the second-highest in nine years for Week 20 (surpassed only by 2021 at 7.6).

Reefer load post volumes continued to improve, boosted by a 2% week-over-week increase in produce shipments and a shortage of available trucks. The reefer load-to-truck ratio was 15.8, the highest in nine years for Week 20. At a national average of $2.05 a mile, reefer spot rates are 6 cents higher than last year.

The flatbed load-to-truck ratio was 41.0 last week due to the capacity crunch during Roadcheck. The national seven-day average reached $2.21 a mile, 16 cents higher than last year and the highest Week 20 rate in three years.

About DAT Freight & Analytics

DAT Freight & Analytics operates DAT One, North America’s largest truckload freight marketplace; DAT iQ, the industry’s leading freight data analytics service; and Trucker Tools, the leader in load visibility. Check out the latest DAT iQ Market Update every Tuesday or on demand: https://www.youtube.com/@datfreight